The term Black Swan is used to describe an unforeseen event that has potentially serious consequences.

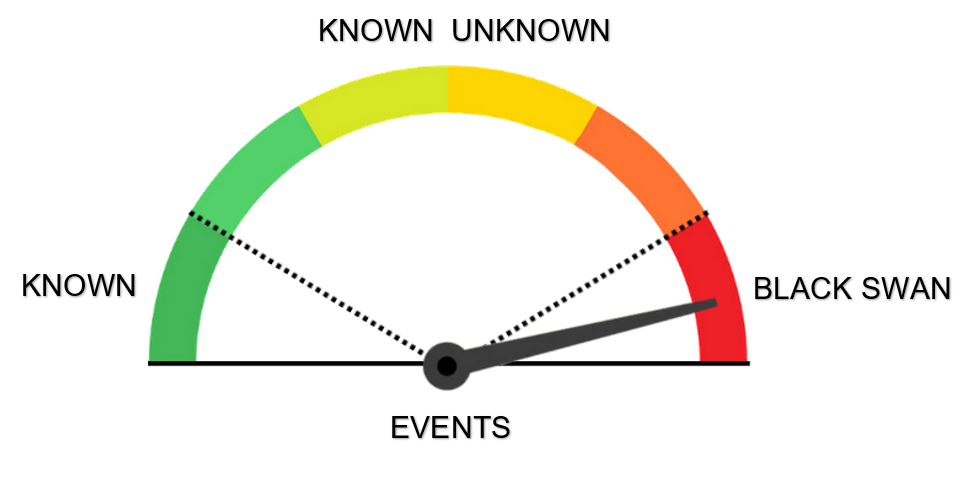

For a better understanding, it is useful to compare a black swan event with a non-black swan event. In the following tachometer graphics, the events are divided into three groups, according to the degree of their variability, i.e. the uncertainty associated with them.

Known events on the left (slow) part of the tachometer are events that are easily predictable and occur regularly. In a business environment, it is, for example, the payment of taxes or current invoices. As these events are predictable, they carry a very low level of risk and the company does not have to prepare specifically for them.

Known unknown events on Wednesday represent events that we know may occur. These events vary in frequency and severity of impact. In other words, we know that this situation can occur, but we cannot predict when it will occur and how serious it will be. In a business environment, an example of such an event may be a loss of contractor or an accident at work. These events involve a greater degree of risk than known events and companies are preparing for them.

The last category in the right (quick) part is represented by unknown events - Black Swan events. This category poses the greatest risk to society because Black Swan events cannot be expected. When such an event occurs, companies lack information and knowledge from the past on how to proceed in such a situation, as these are extremely rare and specific events that we cannot imagine before they actually occur.

The hallmarks of the Black Swan event are:

The term Black Swan was popularized by Nassim Nicholas Taleb, a writer, professor and former businessman on Wall Street, in 2007 before the financial crisis that erupted in 2008. The author chose the metaphor of the black swan because people thought for centuries that there were only white swans and they couldn't even imagine a black swan. This assumption was suddenly refuted after black swans unexpectedly appeared in Australia.

The author of black swan theory also identifies 5 peculiarities of human behavior responsible for blindness to black swans:

Many people associate the term Black Swan with the crisis and believe that contingency plans used in crisis management, business continuity management, effective public relations strategy or risk management will enable their organization to successfully resolve any unforeseen event or crisis.

While this may be true, not all black swans are in crisis. An example of a positive black swan is the bankruptcy of a competitor after unexpected market events, the release of a bestseller, or the unexpected fall of a dictator - for the people he oppressed.

Perhaps more importantly, not all crises are black swans, as evidenced by the difference between the typical earthquake and the earthquake that struck Japan in March 2011 and caused a tsunami. Although earthquakes are relatively common and the relevant organizations expect them and have contingency plans in place, the 2011 earthquake was more than just a crisis. It was a black swan because no one could imagine its size and scope - and organizations were shocked by its amazing effect. Another example of the Black Swan event is the financial crisis of 2008, the sinking of the unsinkable Titanic, or the terrorist attacks in the United States in 2011.

Taleb argues that while Black Swan events are extremely rare and unpredictable, given their potentially catastrophic consequences, it is important that we always consider that they may occur from time to time and plan accordingly.

Many businesses run into difficulties or even disappear completely during Black Swan events, but there are also businesses that survive Black Swan events without much difficulty or even prosper.

Is it just happiness or destiny that determines which business will survive and which will disappear, or is there a key to successfully mastering the Black Swan?

England's leading international risk and insurance management company has found that survival psychology is important in successfully managing the negative effects of Black Swan events.

The psychological consequences of disasters include shock, fear, panic, mistrust, denial, anger and sadness. Companies that do not survive the Black Swan usually show one or more of these reactions.

They often deny this situation or are paralyzed by distrust and indecision. When they act, they are only slow, focusing narrowly on only one possible solution (tunnel vision) and neglecting solutions that could be available immediately. In a competitive business environment, companies cannot normally afford this, and especially not during Black Swan shares, when it comes to the survival of their company.

This is where the psychology of survival comes into play.

The author of The Survivors Club, Ben Sherwood, identifies several commonalities for those who survived the disaster, each of which serves to suppress the psychological consequences of Black Swan:

Successfully managing the Black Swan event is not just about the very survival of the company. It is also a matter of making the most of the bad situation that has arisen and coming out of it better and stronger than before.

If you are interested, CeMS will help you prepare for the negative impact of unexpected events. We have extensive experience in the field of risk management and therefore you will find training in this area in the offer of our training. We also offer BCMS (Business Continuity Management System) certification according to the international standard ISO 22301. Its aim is to prepare companies and protect them in the event of an extraordinary unforeseen event, such as a natural disaster, power failure, fire, lack of personnel, e.g. due to pandemics, etc.

Time Management, Stress Management, Risk Management (Management II)

At the end of February this year, the European Commission issued a proposal to ease ESG reporting obligations. The aim of the proposal is to reduce the administrative burden on businesses associated with sustainability reporting. The proposal responds to the need to strengthen EU competitiveness and align regulation with the real opportunities for businesses.

More

AIAG members and Odette - together with established industry partners and stakeholders have decided to release a new version of MMOG/LE, in order to support the following objectives for a more stable and predictable supply chain.

More

ISO / IEC 17025 is a standard that applies to laboratories in various industries and ensures that standards for laboratory testing and calibration are followed in practice.

More

Recently, we have begun to accumulate events that we are not used to in our latitudes. Apart from the pandemic, we have certainly all caught a tornado in Moravia and other extreme weather events. ISO 22301 specifies business continuity requirements and rules and helps companies recover quickly from unforeseen events. Its aim is to prepare companies and protect them in the event of such an exceptional unforeseen event.

More